Greg Harris, JD, MBA

Staff images taken by Mariana Edelman Photography.

I believe that my MBA, law degree, and public accounting experience give me a unique set of skills that prove extremely valuable to my clients. Most of my clients seek a holistic approach to addressing their financial needs, and want to know that their investment plan, tax plan, insurance plan, and their estate plan are working cohesively.

My background lets me help them make that happen. I have been recognized by LPL Financial for Outstanding Client Service and LPL Financial has been recognized as America’s Leading Independent Brokerage Firm (1996-2021)*. LPL Financial is the first largest broker/dealer in the U.S. by number of advisors. *Based on publicly disclosed information as of 3/31/12.

In 1994, I received a BA (Bachelor of Arts) from Capital University with a double major in International Business and Political Science. In 1998, I received a JD (Juris Doctor) and an MBA (Master of Business Administration) from Case Western Reserve University. After two years at a large accounting firm, I developed a passion for working with families and individuals on their investments, insurance, and estate planning.

I trained to become a financial advisor by passing the General Securities Representative Examination (Series 7), the Uniform Combined State Law Examination (Series 66), as well as the State of Ohio Department of Insurance Examination for Accident & Health, Life, and Variable Annuities, and began my career as a financial advisor in 2000.

Debra (née-Feld) Harris

Chief Growth Officer

Staff images taken by Mariana Edelman Photography.

Debra graduated Summa Cum Laude from University of Maryland with a degree in Family Studies and a certificate in Women’s Studies. She then received her Master’s Degree from the School of Educational Policy and Leadership at The Ohio State University. She combined her love for serving families and youth as a Director of Programs for a non-profit where she had the opportunity to hone her skills in strategic planning, marketing, public relations, event planning, and garnering community and lay leader support.

In 2005, Debra helped found Harris Financial Services. As CGO, she has translated her previous work experiences to serve Harris Financial Services in its efforts to anticipate and provide for the holistic needs of individuals and families, create and execute growth strategies by expanding market presence, cultivate meaningful relationships with clients through fostering long-term, lasting connections to each individual client and family, as well as developing ongoing initiatives to preserve intergenerational continuity of wealth management. She is committed to making Harris Financial Services a genuinely family-oriented practice.

Debra’s contributions to HFS have resulted in a significant increase in our client base, assets under management, and revenue.

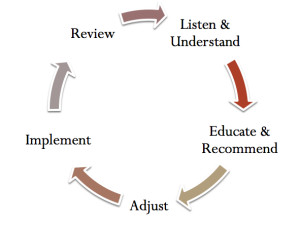

The HFS Process

The Five Step HFS Consultative Process focuses on a commitment to your unique goals and needs. I will help you understand how market fluctuation may impact your financial future, explaining how risk and fees can both be controlled to a large extent.

1) The first step of this process is for me to get to know your needs, your concerns, your goals, and your aspirations. It is in this step of the process that we begin to get to know each other and I can begin to formulate ideas and strategies.

2) The second step involves education and recommendations. I am consultative in my approach and believe in presenting two or three different ideas and helping you understand the pros and cons of each. These two or three recommendations will be based upon your unique needs and objectives.

3) As a third step, adjustments based on your feedback are made.

4) Once we agree on a strategy, that strategy is implemented as a fourth step.

5) Finally, the fifth step is ongoing. I provide my clients with ongoing reviews and analyses of their strategies, performing reviews once every three months and contacting them at those times.

Investment Philosophy

My investment philosophy begins with the belief that knowing my client is paramount in developing a tailored investment strategy that will serve my client well. More important than individual investment selection, I believe, is understanding that investment performance is primarily driven by three things: asset allocation, portfolio risk, and fees.

Market returns are generally unpredictable and therefore can not be controlled by an investor. Risk and fees are investment concerns that can be controlled. I spend a great deal of time with my clients explaining the level of risk that it is appropriate for them to take and constructing portfolios that give them broad diversification and market exposure.

At the same time, I work to minimize fees through selecting what I deem to be the most cost effective implementation of client goals while not sacrificing returns.

When proper asset allocation is formulated and implemented, periodic rebalancing occurs. Securities are bought and sold in order to rebalance the portfolio to its target allocation. Thus, the best performing classes and sectors are sold in favor of adding to positions that trailed during that period. Over time, I believe this strategy mitigates unnecessary risk and increases the chance of out-performing target benchmarks.

*As reported in Financial Planning magazine 1996-2021, based on total revenues.

Investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation do not protect against market risk.

Email Greg

I would be happy to answer any questions you have about your financial situation. Get answers to your most pressing questions.

LPL’s Capabilities